last day to pay mississippi state taxes

1 meaning the 90-day extension to July 15 to file and pay taxes is confined to one fiscal year while it would carry over to two fiscal years on the state level. The time frame can vary based on the method of filing - paper vs electronic.

How Do State And Local Sales Taxes Work Tax Policy Center

WLBT - Mississippi Department of Revenue announced an extension to tax filing.

. The new due date for filing income tax returns is July 15 2020. The ad valorem taxes are to be paid within 90 days. Review You must.

How to Make a Credit Card Payment Income Tax Estimate Payments You can make Estimate Payments through TAP. Taxpayer Access Point TAP Online access to your tax account is available through TAP. Independent Contractors are Not Employees This article is only concerned with employees not independent contractors.

Under current law in arriving at Mississippi taxable income a personal exemption of 6000 single filers 12000 joint filers or 9500 head of family filers is allowed. Mississippi state taxes are due annually on April 15 Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. In addition taxpayers may claim itemized deductions or the state standard deduction 2300.

Calculating your Mississippi state income tax is similar to the steps we listed on our Federal paycheck calculator. The penalty for failure to file a return is imposed after Oct 15 2022. You should request a tracer from the Department of Revenue in writing.

3rd Quarter Due October 31st. The quarterly due dates are listed below. 2nd Quarter Due July 31st.

WCBI If youre a property owner in Mississippi its time to pay up. 1st Quarter Due April 30th. Please take a look at the article below that.

27-41-59 27-41-75. Effective Jul-01-2022 The sales tax on wholesale purchases and wholesale sales of alcoholic beverages. People on the federal and state level of course can file before the deadlines and most likely will want to if they are receiving a refund.

The penalty is 5 per month not to exceed 25 in the aggregate. Mail your request to. Outlines this information and more regarding state refunds when to expect them and what you can do if you believe that.

Quarterly wage reports and taxes are due by the last day of the month following the close of each calendar quarter. Select Make an Estimated Payment from the left hand menu. Property tax deadline passed in Mississippi August 23 2018 WINSTON COUNTY Miss.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Saying Mississippi is unable to follow the Federal July 15 income tax extension due to the 550000000 impact it would have on the state budget the Mississippi Department of Revenue will extend the April 15 tax filing deadline to May 15. Mobile homes must be registered within seven days of either its purchase or movement into the state.

So the tax year 2021 will start from July 01 2020 to June 30 2021. There is an additional convenience fee to pay through the msgov portal. Apt Suite etc City.

Please allow 8-10 weeks to process the request. Up to 25 cash back W-2s filed on paper are due by the last day of February. If the due date falls on a weekend or state holiday the filing due date is the next business working day.

052 of home value Tax amount varies by county The median property tax in Mississippi is 50800 per year for a home worth the median value of 9800000. On this page we have compiled a calendar of all sales tax due dates for Mississippi broken down by filing frequency. The extension applies to individual income tax returns corporate income and franchise tax returns and fiduciary income tax returns.

Depending on the volume of sales taxes you collect and the status of your sales tax account with Mississippi you may be required to file sales tax returns on a monthly semi-monthly quarterly semi-annual or annual basis. Include name address social security number contact number and detailed explanation. This website provides information about the various taxes administered access to online filing and forms.

Late payment penalty and interest apply to any unpaid tax after April 15. Mississippi Property Taxes Go To Different State 50800 Avg. The penalty imposed for failure is based on the amount shown as tax on the return.

All other income tax returns. Mailing addresses are listed below - is October 15 2022 October 17 2022. A dependent exemption generally 1500 per dependent is also allowed.

You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. Ad Valorem taxes on motor vehicles are paid at the time the vehicle is registered for Road and Bridge Privilege Taxes. Late payment penalty will accrue to a maximum of 25.

Cre dit Card or E-Check Payments Pay by credit card or e-check. Mississippi tax year starts from July 01 the year before to June 30 the current year. Withholding tax payments for the month of April are extended until May 15 2020.

Individual Income Tax Division. Mississippis Department of Revenue has extended the deadline to file and pay the 2019 individual income tax and corporate income tax to May 15 2020. All information returns are due by the last day of March.

Up to 25 cash back In Mississippi if you dont pay your real estate taxes on time the property will be sold at a county tax auction to the bidder who will pay the taxes and costs due for the smallest interest in the property. If you are receiving a refund. Deadline for taxpayers who got an automatic MS Tax Extension to file their Mississippi Income Tax Return by mail-in Forms - the Forms incl.

Counties in Mississippi collect an average of 052 of a propertys assesed fair market value as property tax per year. Additionally you may check your state refund status by using the link below. The federal government moved the date from April 15 to July 15 last week.

Jackson MS 39215-1033. Plus the federal fiscal year begins Oct. Like the Federal Income Tax Mississippis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Auctions are held on the first Monday of April or the last Monday of August.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Do I Have To File State Taxes H R Block

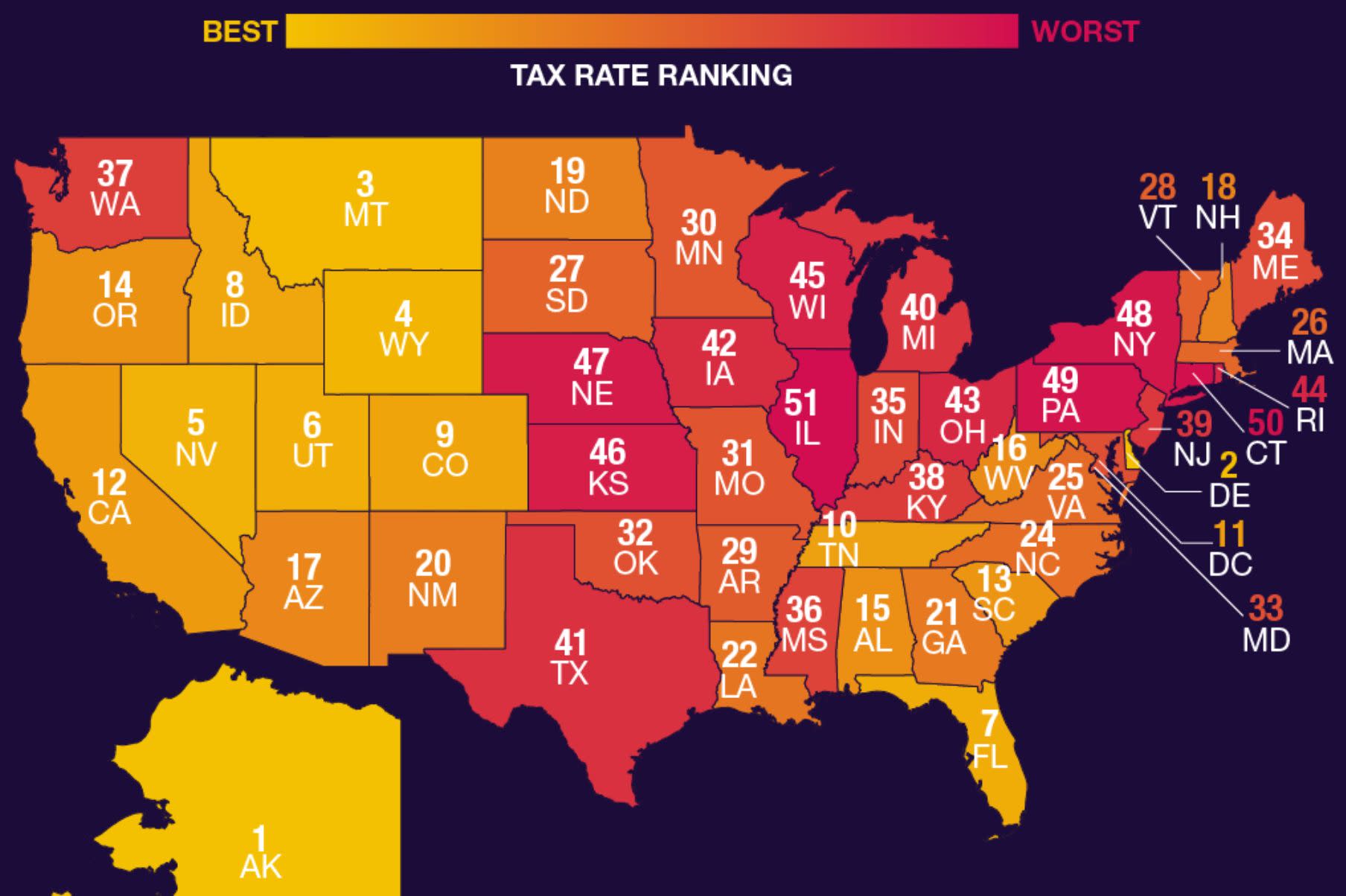

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Marketwatch Retirement Tax Retirement Income

The Best And Worst U S States For Taxpayers

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

Your Tax Bill 107 Days Of Work To Pay Off Interesting Information Freedom Day Thoughts

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

States With No Income Tax H R Block

Location Matters Effective Tax Rates On Corporate Headquarters By State Freedom Day Freedom Charts And Graphs

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

The Most And Least Tax Friendly Us States

State Corporate Income Tax Rates And Brackets Tax Foundation

Taxation Of Social Security Benefits By State Social Security Benefits Map Social Security

Most State Taxes Due April 17 Too Map Us Map Usa Map

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation